| Problems viewing this? Click to view in your browser |

Morning Edition |

|

|

Good morning. How strong is the economic recovery? Will the GDP data released just days before the election be a boost for Ed Miliband or David Cameron? We’ll have a much better idea following the release at 9.30 this morning of the closely watched PMI services data. Economists forecast a reading of 57, up from 56.70 in February. “The services sector remains very much the growth driver for the UK economy and we expect the survey to show activity was again at a robust level in March and slightly up on February,” says Howard Archer, chief UK Economist at IHS Global Insight. It is a slow start after the Easter weekend - with just a handful of stock exchange announcements this morning. Flybe has updated investors, reporting a 5 per cent increase in passenger revenue over the year. For the latest on the markets log on to our Business Now live blog. You can also follow me on Twitter for updates throughout the day - @fletcherr. Richard Fletcher Business Editor The Times richard.fletcher@thetimes.co.uk |

|

|

|

|

Australia’s central bank kept interest rates steady for a second month overnight, defying market pressure for a cut, though it hinted that it remained open to an easing given falling export prices and a stubbornly high local dollar. The currency jumped three quarters of a US cent after the Reserve Bank of Australia (RBA) surprised some by holding rates at 2.25 per cent. “The Board judged that it was appropriate to hold interest rates steady for the time being,” Glenn Stevens, governor, said following the central bank's monthly policy meeting. |

|

|

|

|

One of the world’s biggest digital currency markets is in talks with financial watchdogs about setting up a regulated bitcoin exchange in Britain. Coinbase opened the first regulated bitcoin exchange in the United States this year with $106 million (£71 million) of backing from the New York stock exchange and several banks. Brian Armstrong, the chief executive of Coinbase, said in an interview that the company had been in talks with regulators in the UK “for at least six months” about setting up an exchange. Dairy farmers are bracing themselves for a flood of milk as one of the biggest changes in Europe’s dairy industry in decades comes into effect this week. A European Union quota system for milk production, introduced in 1984, has ended, raising the prospect of cheaper shop prices for dairy produce. More than 2,500 whistleblowers approached the Serious Fraud Office last year, but the crime-fighting agency opened only a dozen investigations into their claims. The tiny proportion of inquiries launched, at less than 1 per cent of all the reports made, has raised questions about resources at the SFO. |

|

|

|

|

In Tokyo the Nikkei 225 has closed up 1.25 per cent at 19,640.54. The FTSE 100 is expected to open up 25 points at 6,858 when trading begins shortly. London’s blue chip index may have fallen some way below last month’s record high of 7,065.08 but it closed on an upbeat note on Thursday. Spurred higher by a surge in shares of Marks & Spencer, which reported its best non-food sales for almost four years, the FTSE 100 rose by 0.4 per cent or 23.96 points to finish at 6,833.5 - still 4 per cent up since the start of the year. The broader FTSE 250 also enjoyed a positive session with a gain of 145.4 points or 0.9 per cent to 17,268.8. US stocks rose on Monday as expectations the Federal Reserve could hold off longer on raising interest rates offset concerns over Friday's surprisingly weak monthly jobs report. The Dow Jones Industrial Average rose 117.61 points, or 0.66 per cent, to 17,880.85; the S&P 500 gained 13.66 points, or 0.66 per cent, to 2,080.62. |

|

|

|

|

|

| The Times | |

| One of the world’s biggest digital currency markets is in talks with financial watchdogs about setting up a regulated bitcoin exchange in Britain. | |

|

|

read full update |

|

|

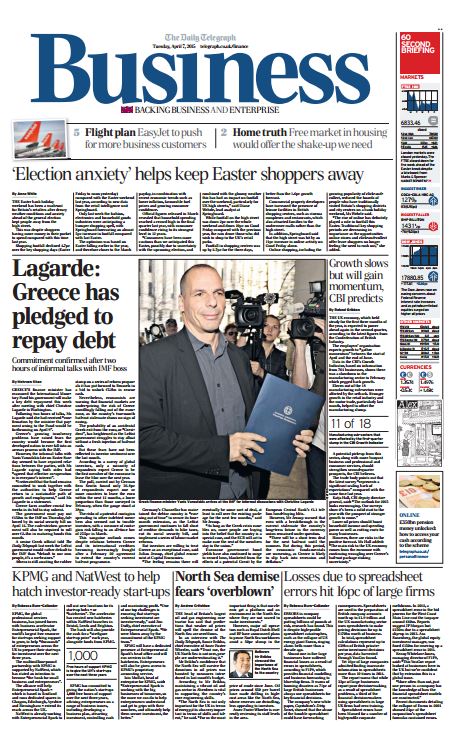

| The Daily Telegraph | |

| Greece's finance minister has reassured the International Monetary Fund his government will make a key debt repayment this week after meeting with chief Christine Lagarde in Washington. | |

|

|

read full update |

|

|

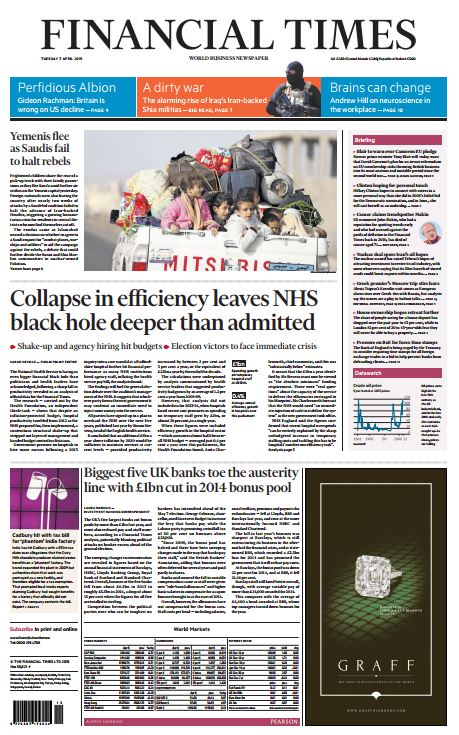

| Financial Times | |

| The National Health Service is facing an even bigger financial black hole than politicians and health leaders have acknowledged, following a sharp fall in productivity revealed in an analysis of official data for the Financial Times. | |

|

|

read full update |

|

|

| City AM | |

| The prime minister of Greece will fly into Moscow today for talks with Russian President Vladimir Putin amid ongoing concern that the Mediterranean country will run out of money this month. | |

|

|

read full update |

|

|

|

| Tuesday |

|

|

At 09.30 the Financial Policy Committee will publish the record of its latest meeting. The FPC is part of the Bank of England’s financial stability objective to identify, monitor and take action to remove or reduce systemic risks to the UK financial system. FPC members include Mark Carney, the Bank’s governor. AGM/EGM Synety Group; LSR Group Economics 09.30 UK: PMI services (Mar) |

|

| Wednesday |

|

|

In the United States, the Federal open market committee meeting minutes are due to be published. A summary of quarterly economic projections made by Federal Reserve Board members and Reserve Bank presidents is also included. The FOMC announced after its last meeting in March that the 0 per cent to 0.25 per cent target range for the federal funds rate “remains appropriate” and that rates would not rise until there was “further improvement” in the labour market. Finals Amerisur Resources Trading statement easyJet; WSP Group; Robert Walters Ex-dividend Verizon Communications; Aviva **Economics ** 09.30 UK: Bank of England Credit Conditions Survey; 08.00 Halifax House Price Index |

|

| Thursday |

|

|

Bank of England’s Monetary Policy Committee announces its latest interest rate decision at midday. The MPC decided at its March meeting to maintain the Bank Rate at 0.5 per cent, unchanged since March 2009, and the size of its quantitative easing programme at £375bn. Minutes of the meeting showed that all nine members of the MPC voted in favour of keeping rates on hold. Interims Matchtech Group; Walgreens Boots Alliance Q2 Finals NetPlay TV; Eurasia Drilling Co AGM/EGM Highway Capital; Intandem Films Trading statement PZ Cussons; Cranswick; Victrex Ex-Dividend: Next; Henderson High Income Trust; Taylor Wimpey; Greggs; Idox; St James’s Place; International Personal Finance; Rotork; Standard Life; IMI; St Ives; Smurfit Kappa Group; Kerry Group ; GKN; Vesuvius; EMIS Group; esure Group; F&C Commercial Property Trust; Berendsen; John Wood Group; Animalcare Group; Chrysalis Vct; Bristol & West; BBA Aviation; Begbies Traynor Group; James Fisher & Sons; Ultra Electronics Holdings; Aberdeen Uk Tracker Trust; 4imprint Group Economics 00.01 UK: RICS house price balance (Mar); 09.30 UK: Trade balance (Feb); 12.00 UK: BoE Asset Purchase Target (Apr); 12.00 UK: BoE rate announcement |

|

| Friday |

|

|

The Apple Watch is available for preview and try-on by appointment at Apple’s retail stores, and available for pre-order online, from today before it goes on sale on April 24 in 24 countries, including Britain and the United States. The smartwatch was launched in September 2014 and Tim Cook, Apple’s chief executive, announced more details about it and the apps that will run on it at an event in San Francisco last month. It is available in three collections — Apple Watch Sport, Apple Watch and the gold-plated Apple Watch Edition, which will cost over £8,000 Finals Huntsworth; Biofrontera Ag AGM/EGM Black Sea Property Fund Trading statement Vedanta Resources; Hays; XP Power Economics 09.30 UK: Industrial production (Feb); 09.30 UK: Manufacturing Production (Feb); 09.30 UK: Construction output (Feb) |

|

| Unsubscribe | Update Profile |

|

This email was sent by: %%Member_Busname%% %%Member_Addr%% %%Member_City%%, %%Member_State%%, %%Member_PostalCode%%, %%Member_Country%% |