| Problems viewing this? Click to view in your browser |

Morning Edition |

|

|

Good morning. It is bad - but not as bad as the City had feared. And that is the key to today’s trading update from J Sainsbury. City analysts had forecast a 2.7 per cent fall in like-for-like sales in the fourth quarter. Like-for-like sales are down - but by just 1.9 per cent. In the current environment that is a win for Mike Coupe, Sainsbury’s chief executive. Nevertheless, Coupe uses today’s trading update to temper shareholder expectations. “We expect the market to remain challenging for the foreseeable future. Food deflation is likely to persist for the rest of this calendar year, and competitive pressures on price will continue,” he warns. We’ll have a full report on Sainsbury’s trading update shortly on www.thetimes.co.uk/business. Just Eat has posted maiden results. The online takeaway ordering service made £57.4 million in the year to December 2014. David Buttress, Just Eat’s chief executive, is upbeat: "It's been another excellent year. Our results demonstrate how we are successfully building market-leading positions. I am delighted with the progress we have made both financially and operationally.” That is all very good - but does £57 million pre-tax profit and 37 per cent rise in “active users” really justify the £2 billion price tag the market currently places on Just Eat? Can we look forward to cheaper mobile phone calls? Ofcom hopes so. The regulator has published its final statement on its review of mobile call termination markets. It is implementing a new charge control which, it claims, will mean termination rates will fall in real terms. The great and the good of the media world gather at the Deloitte media and telecom conference in London. Speakers include WPP’s Sir Martin Sorrell, Jeremy Darroch, chief executive of Sky and ITV’s Adam Crozier. Our Nic Fildes is also there. For the latest from the conference log on to our Business Now live blog or follow him on Twitter - @NicFildes. In the US the Fed starts its latest two-day policy meeting today. We also get housing starts data (at 12.30pm UK time). Economists expect that the pace of starts declined 1.6 per cent to 1.048 million units in February. Have a great day, don’t forget you can follow me on Twitter for updates throughout the day - @fletcherr. Richard Fletcher |

|

|

|

|

The Bank of Japan (BoJ) announced overnight that it would maintain its stimulus programme - pledging to print money at an annual pace of 80 trillion yen. The slump in oil prices has slowed annual core consumer inflation to 0.2 per cent in January, well below a 2 per cent target. “Japan's economy is expected to continue recovering moderately as a trend,” the BoJ said in a statement issued after the decision. |

|

|

|

|

|

|

|

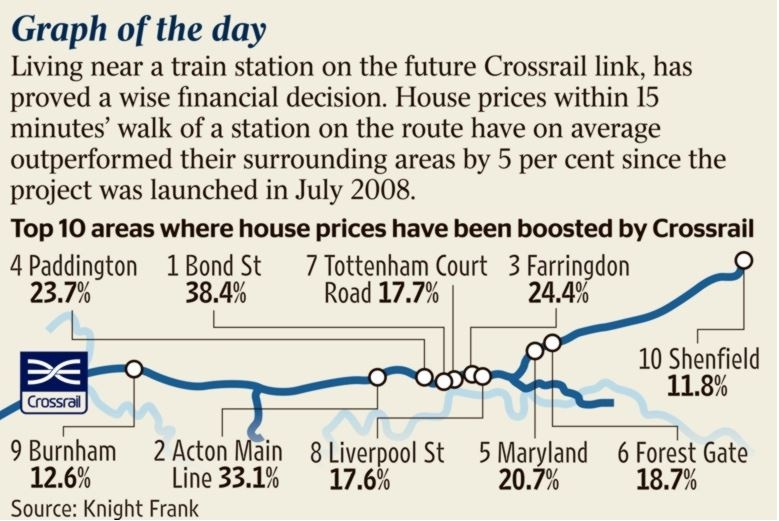

The owner of the Daily Mirror is in talks with Richard Desmond about buying the Daily Express and has been given access to his newspaper group’s confidential accounts, The Times has learnt. A person with knowledge of the situation said the dialogue between Trinity Mirror and Express Newspapers involved an “information-sharing” stage but insisted it was at an early stage. “Dear America, It really is time you took a vacation. I appreciate that you may be scared of being replaced or dread coming back to a mountain of work if you take time off, even if you are ill. Seriously, though, you should take a break.” US workers need to realise that taking a holiday is not an un-American activity, argues Alexandra Frean. Ireland’s cricket and rugby teams may have suffered big losses this week but the country has topped the international league table for rising house prices. The price of a home rocketed 16.3 per cent in Ireland last year, which was double the rate recorded in the UK as the wounded Celtic Tiger continued to rebound from its nadir in early 2013, according to Knight Frank, the estate agency. |

|

|

|

|

In Tokyo the Nikkei 225 has closed up 0.99 per cent this morning at 19,437.00. The FTSE 100 is expected to open eight points lower when trading begins shortly. After its biggest weekly drop of 2015, London’s main index enjoyed a rebound yesterday. Miners boosted the market on expectations of steady growth in China and Tesco shares rose 3.7 per cent on news that WPP, the advertising giant, was eyeing a majority stake in the supermarket’s Dunnhumby customer data arm. The FTSE 100 climbed 63.5 points or 0.9 per cent to 6,804.1. The broader-based FTSE 250 also enjoyed a rally, rising 91.5 points or 0.5 per cent to 17,251. Read Gary Parkinson’s market report here. Wall Street rallied too as the US dollar slipped back from its recent peak and concerns eased about the timing of an interest rate rise by the Federal Reserve. The Dow Jones Industrial Average jumped by 228.1 points or 1.3 per cent to 17,977.4 and the S&P 500 rose by 1.4 per cent or 27.8 points to close at 2,081.2. World stockpiles of oil are growing by 1.6 million barrels a day according to analysts at Société Générale, the French bank. This further evidence pointing to a supply glut was enough to send Brent crude for April settlement sliding 2.2 per cent to $53.45 a barrel yesterday. Sterling halted a four-day decline against the US dollar, rising 0.6 per cent on the day to $1,483 having hit its lowest level since June 2010 of $1.471 on Friday. Against the single currency, the pound weakened 0.5 per cent to 0.713p per euro. BG Group has been out of fashion for much of the past year, after a shock profit warning cost the chief executive his job, says Tempus. One problem area has been Egypt, but a deal at the weekend may offer BG a way out, and the payment of $900 million the company is owed. Faroe Petroleum goes into the 2015 appraisal well drilling programme as well placed as any of the explorers. Analysts are divided about AstraZeneca’s latest trial of its Brilinta heart drug, but on balance the news is positive. Read here for more on the Tempus tips of the day. |

|

|

|

|

|

|

| The Times | |

| The owner of the Daily Mirror is in talks with Richard Desmond about buying the Daily Express and has been given access to his newspaper group’s confidential accounts, The Times has learnt. | |

|

|

read full update |

|

|

| Financial Times | |

| The head of Britain’s spending watchdog has accused Whitehall of failing to grasp the impact of deep public spending cuts. Sir Amyas Morse, who leads the National Audit Office, suggested that civil servants were carrying out “radical surgery” without knowing “where the heart is”. | |

|

|

read full update |

|

|

| Daily Telegraph | |

| The Treasury’s review of business rates could end up with firms paying the same amount of tax despite claims it is the most “ambitious” review for a generation. | |

|

|

read full update |

|

|

| City AM | |

| Apprentices will get a 20 per cent pay rise this October, after business secretary Vince Cable won his battle to overrule the Low Pay Commission’s (LPC) recommendation of a 2.6 per cent rise in the minimum wage. | |

|

|

read full update |

|

|

|

| Economics |

|

|

US manufacturing: American factory output fell in February for the third straight month as the production of cars and a range of other goods tumbled, in the latest sign of slower economic growth in the first quarter. Activity has softened in recent months, held back by a harsh winter, a strong dollar and lower crude prices, which have forced companies in the oil sector to either postpone or to cut back on capital expenditure projects. Germany: European Central Bank largesse and a diminished single currency helped Germany’s Dax index to march past 12,000 points for the first time. It gained 266.1 points, or 2.2 per cent, to 12,167.7 — an improvement of more than 24 per cent since the start of the year. |

|

| Banking & Finance |

|

|

+0.25% Alliance Trust: The investment trust has come under renewed pressure about its performance after its largest shareholder announced a push to install three City heavyweights on its board. In an open letter to shareholders, Elliott Advisors called for an overhaul of the board to improve performance, as it did not believe its concerns had been met with a “meaningful response”. The hedge fund wants to appoint Anthony Brooke, former SG Warburg banker, Peter Chambers, former chief executive of Legal & General Investment Management, and Rory Macnamara, a former corporate financier. Aviva: Mark Wilson, the chief executive of the recovering insurer, received a total of £2.6 million in pay and bonuses last year, fractionally lower than the previous year and despite strong signs that his turnaround strategy was proving effective. Mr Wilson’s base salary remained at £980,000 for a second year. His annual bonus increased from £1.1 million in 2013 to £1.27 million last year, but he received less in other benefits. Shares in Aviva closed 5½p higher at 548½p. Standard Chartered: The departing chief executive of the Asia-focused bank earned more than $5 million (£3.4 million) in his final year, even though he waived his annual bonus after a 30 per cent drop in profits in 2014. Peter Sands, who will leave the bank in June, received $5.1 million, down from $6.8 million in 2013, but his pay was smoothed by an increase in his salary and pension contributions. |

|

| Construction & Property |

|

|

-3.52% Royal Docks: The developer behind Millennium Mills and the surrounding area of Silvertown Quays in east London, which has stood empty for four decades, is expected to receive planning permission to transform it into an area for businesses and 3,000 homes after several failed attempts to revive the derelict part of the Royal Docks. The latest attempt to breathe life into the 62-acre site, this time by the veteran property developer Sir Stuart Lipton and his son Elliott, has been helped by the fact that it falls into the Royal Docks enterprise zone. Royal Institution of Chartered Surveyors: The government should use the budget tomorrow to announce measures to encourage baby boomers with too many rooms in their homes to downsize and free up space for families, according to the organisation. |

|

| Engineering |

|

|

+0.53% Carmakers: Foreign car industry executives in Beijing described “deepening concern” last night for the future after the chairman of one of China’s big four carmakers became the latest senior figure to fall under a corruption investigation. The investigation of Xu Jianyi puts the spotlight on FAW, a state-owned carmaker that builds three million vehicles a year, produces the country’s famous Red Flag brand of official cars and is the local partner company of Toyota, Volkswagen and General Motors. |

|

| Health |

|

|

+1.11% AstraZeneca: Shares in the UK’s second-biggest pharmaceuticals company responded favourably to the results of a test of its Brilinta treatment for heart attacks, which was designed to see if the drug could be used longer term to prevent further cardiovascular events. Valeant Pharmaceuticals International: The battle for control of the US drug maker Salix Pharmaceuticals, which specialises in gastrointestinal treatments, has ended in victory for Canadian pharma corporation Valeant. Salix has agreed to Valeant’s new offer of $173 a share in cash, which is higher than its previous bid of $158 per share, made late last month. The offer tops a cash and stock bid worth about $172.50 a share made last week by Endo International, a US maker of branded and generic drugs that is registered in Ireland. |

|

| Leisure |

|

|

+0.74% Sotheby’s: The auction house has recruited a new chief executive from outside the art world and agreed to split the chairman and chief executive roles after more than a year of pressure from activist investors keen to make it more competitive. The appointment of Tad Smith, the outgoing chief executive of the Madison Square Garden Company, follows months of mounting pressure from Daniel Loeb, the activist investor whose Third Point hedge fund is among Sotheby’s largest shareholders. Mandarin Oriental: The Hong Kong-based luxury hotel group has completed a $316 million (£213 million) rights issue to pay down debt taken on to acquire the freehold of its Paris hotel and fund an £85 million refurbishment of the Mandarin Oriental Hyde Park, London, scheduled to start next year. Jurys Inn: Lone Star Funds has completed the £680 million acquisition of the Irish hotel operator from a consortium comprising Mount Kellett Capital Management, Ulster Bank, Westmont Hospitality Group and Avestus Capital Partners. Center Parcs: In a statement to bondholders, the holiday village operator controlled by Blackstone confirmed that it was “considering its strategic and financing options, which may include private or public equity or debt capital markets”. |

|

| Media |

|

|

+0.96% Trinity Mirror: The owner of the Daily Mirror is in talks with Richard Desmond about buying the Daily Express and has been given access to his newspaper group’s confidential accounts, The Times has learnt. A person with knowledge of the situation said the dialogue between Trinity Mirror and Express Newspapers involved an “information-sharing” stage but said it was at an early stage. However, another source claimed the negotiations were advanced and that Mr Desmond could bank up to £100 million if the sale goes ahead. |

|

| Natural Resources |

|

|

+0.84% Faroe Petroleum: The North Sea oil and gas explorer started drilling at its Shango exploration well in Norwegian waters, one of four appraisal wells to be drilled in the area in 2015. Oil prices: With global stocks of oil ballooning, thoughts have been turning to where to put it all. Oil prices tumbled again yesterday. Brent crude fell $1.44, or 2.6 per cent, to $53.23 a barrel and West Texas Intermediate, the US benchmark, was down $1.39, or 3 per cent, at $43.44. The supply glut means many of the storage facilities are close to capacity. About 200 million barrels of oil will be added to global stocks over the next three months, Société Générale has calculated. China National Petroleum Corporation: Liao Yongyuan, a general manager of the state-owned CNPC, has been placed under investigation for “serious disciplinary violations”, the country’s corruption watchdog announced last night. The Central Commission for Discipline Inspection said last month it had targeted 26 giant state-owned firms for inspections this year, including CNPC, the China National Offshore Oil Corporation and the China National Nuclear Corporation. South32: The £9 billion mining company being carved out of BHP Billiton’s cast-offs issued a sweetener to prospective shareholders last night by pledging to hand at least 40 per cent of its earnings back to investors. BHP for the first time unveiled full details of South32, the spin-off company that will be quoted in London, Sydney and Johannesburg. BHP revealed that the break-up would cost it $738 million (£500 million), but reiterated that it expects the simplification to generate $4 billion in “productivity-led gains” annually by 2017. |

|

| Retailing |

|

|

+1.75% Ikea: A fad for mass games of “hide and seek” at Ikea stores has upset the Swedish furniture retailer. The company has asked organisers to put a halt to games after 32,000 people signed up on Facebook to conceal themselves at a store in Eindhoven, in the Netherlands. Sofaworks: The family-owned furniture retailer has sold a stake to Bill Holroyd, a retail entrepreneur who previously ran Holroyd Meek, a food distribution company. The Greater Manchester Combined Authority has also invested an undisclosed sum in the business under a programme supported by the government’s regional growth fund. Business rates: Shopkeepers have given a cautious welcome to an “ambitious” consultation on business rates by the Treasury, despite a refusal by ministers to countenance any reduction in tax revenue. In a discussion paper, the government posed 15 questions for businesses on the way in which rates, which raise £22 billion annually, are levied on commercial premises. BHS: Richard Price, the chief executive of the retailer sold by Sir Philip Green for a token £1 last week, has already left the business. He resigned prior to the deal being announced, but was expected to stay on to help with the transition to the new owners, Retail Acquisitions, according to Sky News. Hugo Boss: Close to €1 billion of shares in the luxury fashion chain could be sold tomorrow, allowing Permira to end its investment in the German retailer. Permira, the private equity group which took a majority stake in Hugo Boss in 2007, is close to placing its final tranche of stock in the company at between €112 and €118 a share, The Times understands. If the placing, which is being carried out by Bank of America Merrill Lynch and UBS, is successful it could mean that Permira is on track to generate a return of about 2.2 times its original investment. |

|

| Technology |

|

|

+1.10% Market Tech Holdings: Teddy Sagi, the Israeli billionaire who made his money from gambling software, took another step towards transforming Camden Market from a bovver boots-and-biker jackets tourist trap into an internet retailer. Market Tech, the £929 million property-cum-ecommerce business in which he holds an 86.4 per cent stake, paid €32 million (£23 million) for Glispa, a Berlin-based digital marketing company, whose customers include Amazon and Alibaba. Pinterest: The popular digital scrapbook site has raised $367 million and is seeking to raise $208 million more, according to a regulatory filing. The present round includes new and existing investors, according to The Wall Street Journal, which reports that the new funding was at an $11 billion valuation, making the start-up one of the most highly valued in the world. |

|

| Transport |

|

|

+0.38% Ryanair: Having spent the past year or more trying to rehabilitate the Ryanair brand, Michael O’Leary is looking for an alternative name for his planned transatlantic operations. The Ryanair chief executive remains four or five years away from launching services from London and Dublin to New York and a dozen more US cities. He has promised transatlantic flights from £10, although these tickets would be limited to only a few that would be rapidly snapped up. |

|

| Unsubscribe | Update Profile |

|

This email was sent by: %%Member_Busname%% %%Member_Addr%% %%Member_City%%, %%Member_State%%, %%Member_PostalCode%%, %%Member_Country%% |